What are Monthly Income Plans?

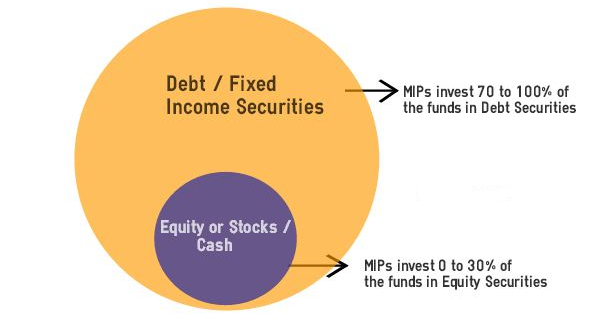

An MIP is a debt oriented mutual fund which gives you income, in the form of dividends. As MIPs are debt oriented mutual funds, they invest heavily in debt instruments like debentures, corporate bonds, government securities etc. It generally has 75-80% of its money in debt and rest in equity and cash. The income you can get from MIP is not limited to the monthly option. You can also choose to receive income quarterly, half-yearly or annually.

Mutual Funds - Monthly Income Plan (MIP)

Who should invest in MIPs ?

1. Investors looking for regular income

2. Conservative investors looking for better returns

3. Investors who want to park a big sum of money

Disclaimer-Investment Recipe has, to the best of its ability, taken into account various factors - both quantitative measures and qualitative assessments, in an unbiased manner, while choosing the fund(s) mentioned above. However, they carry unknown risks and uncertainties linked to broad markets, as well as analysts' expectations about future events. They should not, therefore, be the sole basis of investment decisions. The recommendations and reviews do not guarantee fund performance, nor should they be viewed as an assessment of a fund's, or the fund's underlying securities' creditworthiness. Mutual fund investments are subject to market risks. Please read the scheme information and other related documents before investing. Past performance is not indicative of future returns. Lakshya Jain (with ARN code 84703) makes no warranties or representations, express or implied, on products offered through the platform and accepts no liability for any damages or losses, however caused, in connection with the use of, or on the reliance of its product or related services. Terms and conditions of the website are applicable.